The 5G IoT Market is currently experiencing a transformative phase, characterized by rapid advancements in connectivity and device integration. This evolution is driven by the increasing demand for high-speed internet and the proliferation of smart devices across various sectors. Industries such as healthcare, manufacturing, and transportation are leveraging the capabilities of 5G technology to enhance operational efficiency and improve service delivery. The integration of artificial intelligence and machine learning with IoT devices further amplifies the potential of this market, enabling real-time data processing and decision-making. As organizations seek to optimize their processes, the adoption of 5G IoT Market solutions appears to be a strategic priority, fostering innovation and competitive advantage.

The convergence of 5G and IoT technologies is transforming digital connectivity by enabling faster data transmission, ultra-low latency, and massive device integration. The 5G Internet of Things (5G IoT) represents a new generation of connected ecosystems, supporting advanced industrial, consumer, and enterprise applications across the global 5G IoT market. The adoption of 5G for IoT applications is accelerating due to its ability to deliver reliable 5G IoT connectivity for mission-critical use cases such as industrial automation and smart cities. Additionally, the overall growth in IoT adoption across industries is acting as a major catalyst for the expansion of the 5G IoT ecosystem.

Moreover, the 5G IoT Market is likely to witness a surge in applications that require low latency and high reliability. This trend is particularly evident in sectors such as autonomous vehicles and smart cities, where seamless communication between devices is crucial. The ongoing development of infrastructure to support 5G networks is expected to facilitate broader access and enhance user experiences. As stakeholders continue to invest in this technology, the market's landscape is poised for significant growth, with new opportunities emerging for both established players and startups alike. The future of the 5G IoT Market seems promising, as it holds the potential to reshape industries and improve quality of life on a global scale.

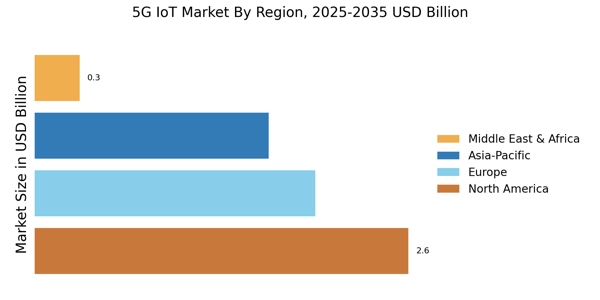

The increasing deployment of 5G IoT devices across consumer electronics, healthcare, and manufacturing is strengthening market demand for high-speed, low-latency communication solutions. The 5G industrial IoT market is witnessing rapid growth as industries adopt smart manufacturing, predictive maintenance, and real-time monitoring solutions enabled by 5G networks. The evolution of 5G IoT technology enables seamless communication between billions of connected devices, positioning the 5G Internet of Things as a foundational pillar for next-generation digital infrastructure. Regions with a large IoT market size, such as North America and Asia-Pacific, are witnessing faster adoption of 5G-enabled solutions, supporting the overall expansion of the 5G IoT Market.

Increased Device Connectivity

The 5G IoT Market is witnessing a notable rise in the number of connected devices. This trend is driven by the need for seamless communication and data exchange among various devices. As more industries adopt IoT solutions, the demand for reliable connectivity continues to grow, leading to enhanced operational capabilities.

Enhanced Data Processing

With the advent of 5G technology, the ability to process vast amounts of data in real-time is becoming increasingly feasible. This capability allows organizations to make informed decisions quickly, improving efficiency and responsiveness. The integration of advanced analytics tools further supports this trend.

Focus on Sustainability

Sustainability is emerging as a key consideration within the 5G IoT Market. Companies are increasingly looking to implement eco-friendly solutions that reduce energy consumption and minimize environmental impact. This focus on sustainability is likely to drive innovation and attract investment in green technologies.